How to Choose the Right Accounting Software for Your Business

Select the right accounting software for your business by assessing your financial needs and comparing features. Ensure it integrates with your current systems for seamless operation.

The quest for the perfect accounting software can seem daunting amidst an ocean of choices, each promising to streamline your financial management. Yet, this decision can significantly impact your business efficiency and financial clarity. It’s crucial to choose software that not only tackles your accounting needs but also grows with your business.

A well-suited accounting platform simplifies bookkeeping, provides insightful reports, and improves financial decision-making. By focusing on your specific business requirements, including scalability, usability, and compatibility with existing processes, you can identify a solution that enhances your financial operations without disrupting your established workflow. With thorough research and a clear understanding of your business goals, investing in the right accounting software becomes an empowering step towards financial mastery and business success.

Understanding Your Business Needs

Understanding Your Business Needs is a pivotal step before diving into the myriad of accounting software options available. It’s all about finding a glove-like fit for your financial tracking and reporting requirements. Let’s break down this critical decision into manageable chunks.

Assessing Your Current Processes

Begin by looking at the way your business handles its finances. Are manual methods slowing you down? Are spreadsheets becoming overwhelming? It’s vital to acknowledge where your current system lacks efficiency to pave the way for a software solution that caters to your operation’s scale and speed.

- Efficiency: Measure time spent on accounting tasks.

- Accessibility: Note who needs access to financial data.

- Integration: List current tools that should integrate with new software.

Identifying Key Accounting Requirements

Every business has unique financial needs. Some need advanced inventory tracking; others might seek detailed reporting. What are your deal-breakers?

Essential features to consider:

- Invoicing and expense tracking

- Payroll processing

- Tax preparation

- Real-time data and reporting

- Scalability for business growth

Analyze these features against your business goals. Match them to ensure your choice in software is one that will support and sustain your financial well-being for years to come.

Credit: www.forbes.com

Researching Available Options

Choosing the right accounting software is crucial for your business. A thorough research on available options is essential before making a decision. It involves understanding your business needs, budget constraints, and scalability for future growth. This section delves into how to explore various software solutions and compares cloud-based systems with on-premises options.

Exploring Different Software Solutions

Identify the features you need for your business operations.

- Simple invoicing

- Expense tracking

- Inventory management

Research user reviews and ask for free trials. Understand compatibility with your existing systems.

| Software | Core Features | User Rating |

| Software A | Invoicing, Tracking, Reporting | 4.5/5 |

| Software B | Payroll, Taxes, Integration | 4.0/5 |

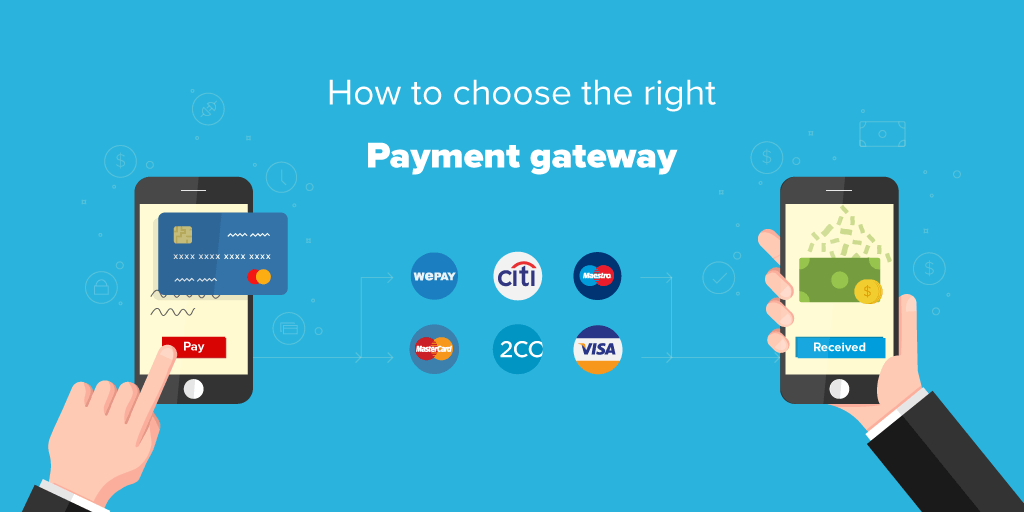

Considering Cloud-based Vs. On-premises Solutions

Deciding between cloud-based and on-premises accounting software is crucial.

Cloud-based software enables access from anywhere. It often includes regular updates and lower upfront costs.

On-premises solutions require a one-time installation. They provide control over your data on your servers.

| Type | Pros | Cons |

| Cloud-Based | Accessibility, Scalability | Subscription fees |

| On-Premises | Data control, One-time cost | Upkeep, Less flexibility |

Evaluating Key Features

Finding the perfect accounting software can be tricky. Key features determine how well it fits your business.

Scalability And Customization

Your business will grow. Your accounting software should too. Scalability means the software can handle your business as it expands. Customization allows you to tweak features to meet your specific needs.

- User count: Check if you can add more users later.

- Data limits: Ensure there’s room for your growing data.

- Feature upgrades: Look for options to add functionalities as needed.

Integration With Other Business Systems

Integration links your accounting software with other tools you use. This saves time and prevents errors.

Consider these questions:

| Integration Point | Why It Matters |

| Bank accounts | Automatic transaction updates. |

| Payment processing | Streamline invoice and billing. |

| CRM | Sync customer data easily. |

Look for software that talks to the tools your business uses every day.

Credit: www.zoho.com

Assessing User-friendliness And Support

Choosing the right accounting software is pivotal for streamlined financial management. A critical aspect to consider is how user-friendly and supportive the software is for your team.

User Interface And Accessibility

An intuitive user interface makes training staff and navigating the platform efficient and stress-free. Look for software with a clean layout, clear labels, and logical navigation.

Accessibility is key. Ensure the software works well across various devices, like computers, tablets, and smartphones. This flexibility allows your team to stay productive on-the-go.

- Dashboard: Essential tools should be easily accessible upon login.

- Help Guides: Look for built-in tutorials or help sections for quick learning.

- Search Functionality: A robust search tool can save time finding specific functions or records.

Quality Of Customer Support

Your chosen software should come with reliable customer support. Support availability and response times are crucial for resolving issues swiftly.

| Support Type | Details |

| Phone | Direct line to support staff during business hours. |

| Expect responses within 24 hours; ideal for non-urgent issues. | |

| Live Chat | Instant help for quick queries during work hours. |

| Community Forums | Peer-to-peer assistance and knowledge base for common questions. |

Good customer support also includes a knowledgeable team that understands accounting practices. This ensures queries receive accurate resolutions.

Considering Cost And Roi

Choosing the right accounting software involves more than just comparing prices. It’s vital to consider both the initial cost and the potential return on investment (ROI). This means evaluating how the software will contribute to your business’s efficiency and profitability over time.

Upfront Costs Vs. Long-term Value

When selecting accounting software, consider both the upfront costs and the potential long-term value. Upfront costs include purchase price or subscription fees, installation, and training for your team. It’s important to look beyond these initial expenses. Evaluate the benefits that the software provides over the years. These benefits might include time savings, accuracy in financial reporting, or better cash flow management. All these advantages contribute to the overall value of your investment.

Scalability And Additional Expenses

Business growth means changes in accounting needs. Your chosen accounting software should scale with your business without incurring prohibitive costs. Here’s a consideration list:

- Upgrading plans or modules as your business expands

- Integration capabilities with other systems

- Customer support and training availability

- Regular updates and improvements to the software

Evaluate each software option for its ability to grow with your company. Look for flexible platforms that offer tiered pricing based on features or usage levels. It will ensure you’re not paying for unnecessary features early on, yet have the option to add them as needed. This strategic approach will help you manage costs effectively while ensuring continued ROI.

Credit: www.zoho.com

Frequently Asked Questions For How To Choose The Right Accounting Software For Your Business

What Features Are Essential In Accounting Software?

Choosing the right accounting software requires looking for essential features like ease of use, comprehensive accounting reports, multi-user access, integration capabilities, and secure data backup. These core functionalities ensure efficient financial management.

How Does Accounting Software Improve Financial Management?

Accounting software streamlines financial tasks through automation, minimizing errors and saving time. It provides real-time financial insights, enabling better decision-making and efficient cash flow management, which are crucial for any business’s financial health.

What Are The Benefits Of Cloud-based Accounting Software?

Cloud-based accounting software offers accessibility from any device with an internet connection. It ensures data security, offers real-time collaboration, and often comes with lower upfront costs due to the subscription-based model.

How To Ensure Accounting Software Scalability For Business Growth?

Look for accounting software that offers modular add-ons or scalable plans. This will ensure that as your business grows, you can expand its functionalities without switching to a new system, protecting your investment and adapting to increased demands.

Conclusion

Selecting ideal accounting software is pivotal for streamlined financial management. Assess features, scalability, and support diligently. Securely invest in a system that aligns with your operational needs. Leverage this guide to empower your business with the right financial tools. Embrace progress with a choice that fuels growth and efficiency.